montana sales tax rate 2021

Start filing your tax return now. 2022 Montana Sales Tax Table.

Montana State Taxes Tax Types In Montana Income Property Corporate

Tax rates last updated in August 2022.

. You can find your sales tax rates using the below table please use the search option for faster searching. The minimum combined 2022 sales tax rate for Montana City Montana is. Montana Sales Tax Rates 2021.

The Montana Department of Revenue administers the states licensing distribution and taxation on Alcoholic Beverages. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. This is the total of state and county sales tax rates.

Free Unlimited Searches Try Now. The Helena sales tax rate is NA. Are charged at a higher sales tax rate than.

The State of Montana imposes a variety of registration fees on motor vehicles trailers and recreational. The current total local sales tax rate in East Helena MT is 0000. The minimum combined 2021 sales tax rate for Lincoln County Montana is.

MONTANA LEGISLATIVE BRANCH. AUGUST 31 2021. What is the sales tax rate in Lincoln County.

Look up 2021 sales tax rates for Proctor Montana and surrounding areas. This is the total of state county and city sales tax rates. In Montana theres a tax rate of 1 on the first 0 to 3100 of income for single or married filing taxes separately.

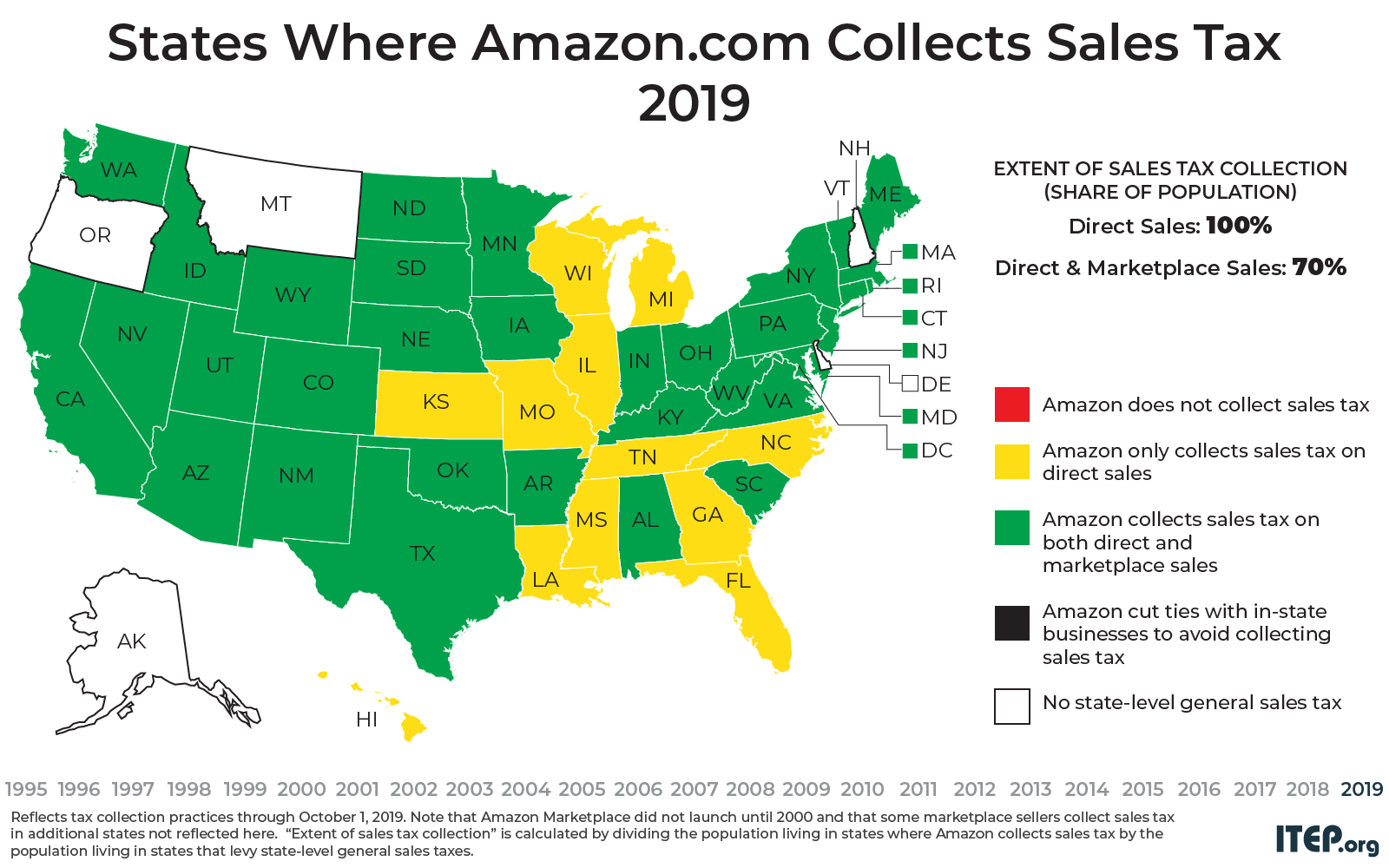

Because there is no. Tax rates are provided by Avalara and updated monthly. Explore 2021 sales tax by state.

Montana Income Tax Range. 368 rows There are a total of 68 local tax jurisdictions across the state collecting an average. Department Rulemaking Filings for August 26.

There is 0 additional. Sales tax region name. 525 705 and SB 320 enacted by 2021 Montana Legislature.

We have tried to include all the cities that come. Compare 2021 sales tax rates by state with new resource. 2021 and updated national and Montana forecasts from IHS.

2021 state and local sales tax rates. Sales tax region name. Tax rates last updated in August 2022.

Beginning in 2024 there will. Ad Lookup MT Sales Tax Rates By Zip. Montana Tax Rate Information.

Vehicle owners to register their cars in Montana. The Missoula sales tax rate is NA. You can learn more about licensing and distribution from the Alcoholic.

Method to calculate Montana sales tax in 2021. Special taxes in Montanas resort areas are. TAX DAY NOW MAY 17th - There are -461 days left until taxes are due.

For 2022 the 1 rate applies to taxable income up to 3300 and the top rate is 675 on taxable income over 19800. Lodging Facilities Sales Tax 25058 20878 30589 36378 20374 30187 37441 0156 02. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the.

There is 0 additional tax. Alcoholic Beverage Control Publications. What is the sales tax rate in Montana City Montana.

The December 2020 total local sales tax rate was also 0000. Is any tax thats imposed by the.

States Without Sales Tax Article

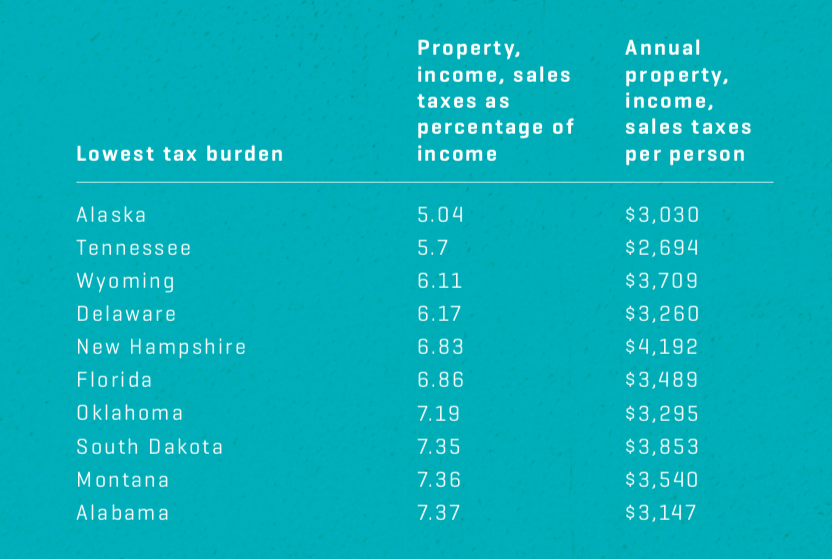

Tax Policy States With The Highest And Lowest Taxes

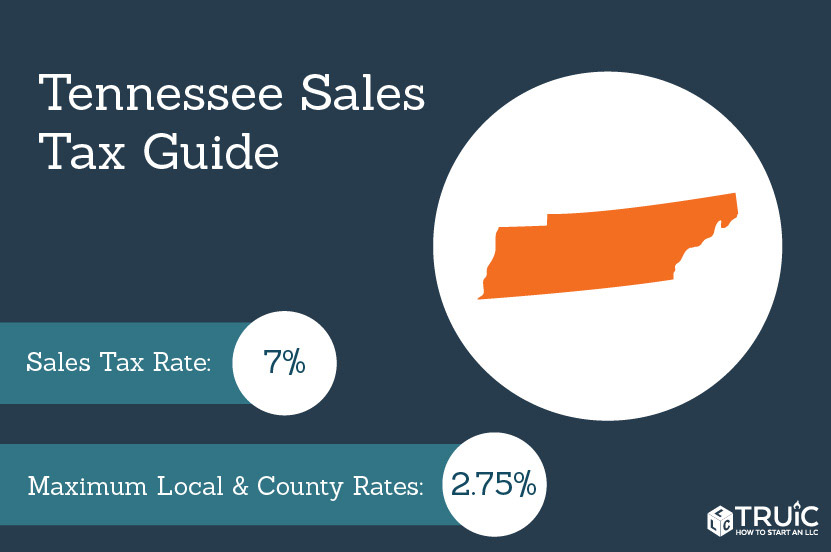

Tennessee Sales Tax Small Business Guide Truic

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

State Corporate Income Tax Rates And Brackets Tax Foundation

Tax Rates To Celebrate Gulfshore Business

States Without Sales Tax Article

How Is Tax Liability Calculated Common Tax Questions Answered

How To Charge Sales Tax In The Us 2022

How High Are Cell Phone Taxes In Your State Tax Foundation

Madison County Sales Tax Department Madison County Al

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

States With The Highest And Lowest And No Sales Tax Rates States With Lowest Local Sales Tax Youtube

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)